Recent Blog Posts

Understanding What Muniment of Title Means in Texas

In the realm of estate planning, the term "muniment of title" holds significant importance, especially in Texas. Muniment of title refers to a legal document that serves as evidence of ownership and transfers property rights without the need for probate. Contact a distinguished lawyer to learn more about the muniment of title and see if it is relevant to your estate plan.

In the realm of estate planning, the term "muniment of title" holds significant importance, especially in Texas. Muniment of title refers to a legal document that serves as evidence of ownership and transfers property rights without the need for probate. Contact a distinguished lawyer to learn more about the muniment of title and see if it is relevant to your estate plan.

Definition and Purpose

In Texas, a muniment of title is a document, typically a will, admitted to probate court to establish ownership and transfer property rights. It is evidence of a valid property transfer without needing full probate administration. Muniments of title are commonly used when a property owner passes away, and the property is transferred to heirs or beneficiaries as specified in the will.

What is a Transfer on Death Deed in Texas?

In Texas, a Transfer on Death Deed (TODD) is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death without the need for probate. This relatively new estate planning tool provides flexibility and control over the distribution of property while avoiding the complexities and costs associated with the probate process. If you are interested in pursuing this estate planning tool, contact a qualified lawyer to make your goal a reality.

In Texas, a Transfer on Death Deed (TODD) is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death without the need for probate. This relatively new estate planning tool provides flexibility and control over the distribution of property while avoiding the complexities and costs associated with the probate process. If you are interested in pursuing this estate planning tool, contact a qualified lawyer to make your goal a reality.

Definition and Purpose of a TODD

A Transfer on Death Deed, also known as a beneficiary deed, is a legal instrument that allows property owners to designate one or more beneficiaries who will automatically inherit the property upon the owner’s death. The primary purpose of a TODD is to facilitate the transfer of real estate outside of the probate process, thereby saving time and money for both the property owner and the beneficiaries.

Do-Not-Resuscitate Orders and Advance Medical Directives

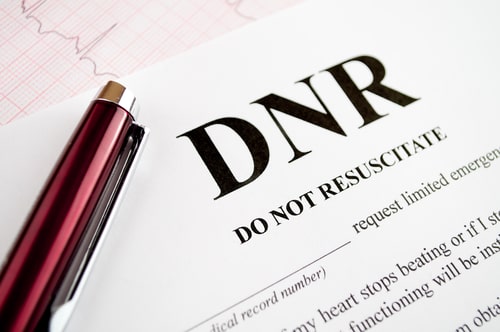

Do-not-resuscitate (DNR) orders and advanced medical directives (AMDs) are legal documents in Texas that allow individuals to make decisions regarding their medical care in advance. If you want to sign an advanced medical directive such as a do-not-resuscitate order, contact an experienced estate planning lawyer to start the process today. Your lawyer will be able to explain their purpose, legal implications, and how they help ensure a person’s medical wishes are respected, even if they are unable to communicate them during a medical emergency.

Do-not-resuscitate (DNR) orders and advanced medical directives (AMDs) are legal documents in Texas that allow individuals to make decisions regarding their medical care in advance. If you want to sign an advanced medical directive such as a do-not-resuscitate order, contact an experienced estate planning lawyer to start the process today. Your lawyer will be able to explain their purpose, legal implications, and how they help ensure a person’s medical wishes are respected, even if they are unable to communicate them during a medical emergency.

Do-Not-Resuscitate Orders (DNR)

A DNR is a medical directive that instructs healthcare professionals not to perform cardiopulmonary resuscitation (CPR) or other life-saving measures in the event of cardiac or respiratory arrest. A physician typically writes DNR orders based on a patient’s informed consent. These orders are especially relevant for people with terminal illnesses or those who have made a conscious decision to avoid aggressive medical interventions. DNR orders must comply with state laws and are typically recorded in a patient’s medical records to ensure they are honored during emergencies.

Do I Need to Prepare Before Going to Probate Court?

Facing a probate court appearance can be a daunting experience for anyone. Before going to probate court, it is essential that you prepare for your appearance. The first step anyone should take before going to probate court is to hire a qualified and experienced estate planning lawyer. Before going to court, you and your Texas attorney will prepare thoroughly for your appearance. Once your court date arrives, your lawyer will join you in the courtroom as you work through whatever legal matters you need to. Appearing in probate court without a lawyer increases your chances of an unfavorable case outcome.

Important Considerations as You Prep for Dallas County Probate Court

Make no mistake, probate court can be extremely complex. This is one of the reasons why arriving at court with a lawyer is so important. However, it is also essential to do some prep of your own before heading to court. Try to familiarize yourself with the legal process before your court appearance. While this certainly will not make you an expert overnight, you will at least be familiarizing yourself with the specific procedures, rules, and requirements that apply to your probate case. This may include understanding the role of the different parties involved and more.

Understanding the Basics of a Special Needs Trust

A special needs trust (SNT) is a crucial legal tool designed to provide for individuals with disabilities while preserving their eligibility for government benefits. It ensures that individuals with special needs receive the financial support they may require in a thoughtful and structured manner. Today, we will explore the fundamentals of a special needs trust, its importance, and some key considerations when establishing one. To see if a special needs trust may be suitable for a loved one, contact an estate planning attorney to learn more about what such trusts entail.

A special needs trust (SNT) is a crucial legal tool designed to provide for individuals with disabilities while preserving their eligibility for government benefits. It ensures that individuals with special needs receive the financial support they may require in a thoughtful and structured manner. Today, we will explore the fundamentals of a special needs trust, its importance, and some key considerations when establishing one. To see if a special needs trust may be suitable for a loved one, contact an estate planning attorney to learn more about what such trusts entail.

Defining a Special Needs Trust

A special needs trust is a legal arrangement where a trusted individual or entity, known as a trustee, is designated to hold and manage assets on behalf of a person with special needs, known as a beneficiary. The primary objective of an SNT is to supplement the government benefits the individual may receive without jeopardizing their eligibility for programs such as Medicaid and Supplemental Security Income (SSI).

I Have Children But Few Assets. Should I Still Create a Will?

Creating a will is a common consideration for individuals with assets, but what about those with few assets? You may wonder if there is still a need for a will. The answer is yes, especially if you have children. Today, we will explore the many reasons why having a will is essential, regardless of your asset status. If you are interested in taking this important estate planning step, contact an experienced estate planning lawyer to guide you through the process.

Creating a will is a common consideration for individuals with assets, but what about those with few assets? You may wonder if there is still a need for a will. The answer is yes, especially if you have children. Today, we will explore the many reasons why having a will is essential, regardless of your asset status. If you are interested in taking this important estate planning step, contact an experienced estate planning lawyer to guide you through the process.

Here is Why Creating a Will, Regardless of Your Wealth, is So Important

The following are reasons why you should still create a will even if you have limited resources:

- Naming a guardian for your children – One of the most critical reasons to create a will is to appoint a guardian for your children if you pass away. Without a will, such considerations may be left to the courts. By creating a will, you can retain control over this critical decision and ensure your children will be cared for by someone you trust.

What Are the Benefits of an Irrevocable Trust?

When we discuss trusts in the context of estate planning, we often focus on revocable trusts. While revocable trusts have many uses and benefits, including the fact that they can be dissolved and modified, there are certain situations in which an irrevocable trust may be more beneficial. In this blog, we will discuss the unique benefits of an irrevocable trust and explain situations in which an irrevocable trust may be the best option for meeting your needs.

When we discuss trusts in the context of estate planning, we often focus on revocable trusts. While revocable trusts have many uses and benefits, including the fact that they can be dissolved and modified, there are certain situations in which an irrevocable trust may be more beneficial. In this blog, we will discuss the unique benefits of an irrevocable trust and explain situations in which an irrevocable trust may be the best option for meeting your needs.

Irrevocable Trust Advantages and Disadvantages

An irrevocable trust is a powerful estate planning tool that offers numerous benefits. Many people use an irrevocable trust to protect assets from creditors or lawsuits. With an irrevocable trust, the assets placed into it are no longer owned by the grantor, so they cannot be seized under most circumstances. For example, a doctor or surgeon may use an irrevocable trust to protect their assets from future malpractice claims.

7 Reasons to Include a Living Trust in Your Estate Plan

Estate planning is crucial for everyone, regardless of their economic circumstances or family relationships. With an estate plan in place, you can make sure your assets will be handled correctly both before and after your death, and you can make provisions to ensure that your loved ones will be cared for properly while also addressing your own needs. While a will is an essential part of any estate plan, it may not be sufficient to protect your assets and ensure that your family's needs will be met. A living trust can be an important addition to your estate plan, and it can offer numerous benefits that other estate planning tools cannot.

Estate planning is crucial for everyone, regardless of their economic circumstances or family relationships. With an estate plan in place, you can make sure your assets will be handled correctly both before and after your death, and you can make provisions to ensure that your loved ones will be cared for properly while also addressing your own needs. While a will is an essential part of any estate plan, it may not be sufficient to protect your assets and ensure that your family's needs will be met. A living trust can be an important addition to your estate plan, and it can offer numerous benefits that other estate planning tools cannot.

Benefits of Living Trusts

A living trust is a legal entity that you can use to hold and manage your assets during your lifetime while providing instructions for how assets will be distributed to different beneficiaries. Assets in a trust are managed by a trustee, and they may be distributed to multiple different beneficiaries. With a living trust, you can name yourself as a beneficiary, ensuring that you can use your assets during your lifetime, and you can change the terms of the trust at any time to distribute assets to beneficiaries either before or after your death.

When Does an Elderly Person Need a Medical Power of Attorney?

As people age, their medical needs become more complex. It is important for a person and their loved ones to plan for the future in case they become unable to make decisions for themselves. In such situations, a Medical Power of Attorney (MPOA) can be a crucial tool that provides a trusted family member or friend with the legal authority to make medical decisions on a person's behalf. Elderly people and their loved ones will want to understand the situations where having an MPOA may be necessary, and they will also want to be aware of what specific issues a Medical Power of Attorney may address.

As people age, their medical needs become more complex. It is important for a person and their loved ones to plan for the future in case they become unable to make decisions for themselves. In such situations, a Medical Power of Attorney (MPOA) can be a crucial tool that provides a trusted family member or friend with the legal authority to make medical decisions on a person's behalf. Elderly people and their loved ones will want to understand the situations where having an MPOA may be necessary, and they will also want to be aware of what specific issues a Medical Power of Attorney may address.

Understanding the Benefits of an MPOA

A Medical Power of Attorney will allow a person to designate someone they trust to make decisions about their medical care in the event of an emergency or if they are no longer able to do so. If a senior citizen has dementia, is in a coma, or is incapacitated in any other way, a medical power of attorney will go into effect, and their health care agent (the person named in the MPOA) will be able to make decisions on their behalf.

Probate Vs. Non-Probate Assets: What You Need to Know

When it comes to estate planning, there are a variety of issues to consider. A person or family that creates an estate plan will need to make decisions about what will happen after someone's death, although issues related to medical care, personal care, and financial concerns while they are still alive may also be an important consideration. When determining how to distribute different assets to a person's heirs after their death, it is important to understand the difference between probate and non-probate assets. In a nutshell, probate assets are those that must be considered during the probate process, which must take place before title transfers can be performed. Non-probate assets, on the other hand, will not be considered during the probate process. By understanding how different types of assets will be transferred to beneficiaries, a person can rest assured that their affairs will be handled correctly after they are gone.

972-807-6357

972-807-6357